Ethos Veterinary Health is a unique community of cutting-edge specialty and emergency veterinary hospitals with a shared vision of revolutionizing veterinary medicine and united by a dedication to compassionately serving pets and people.

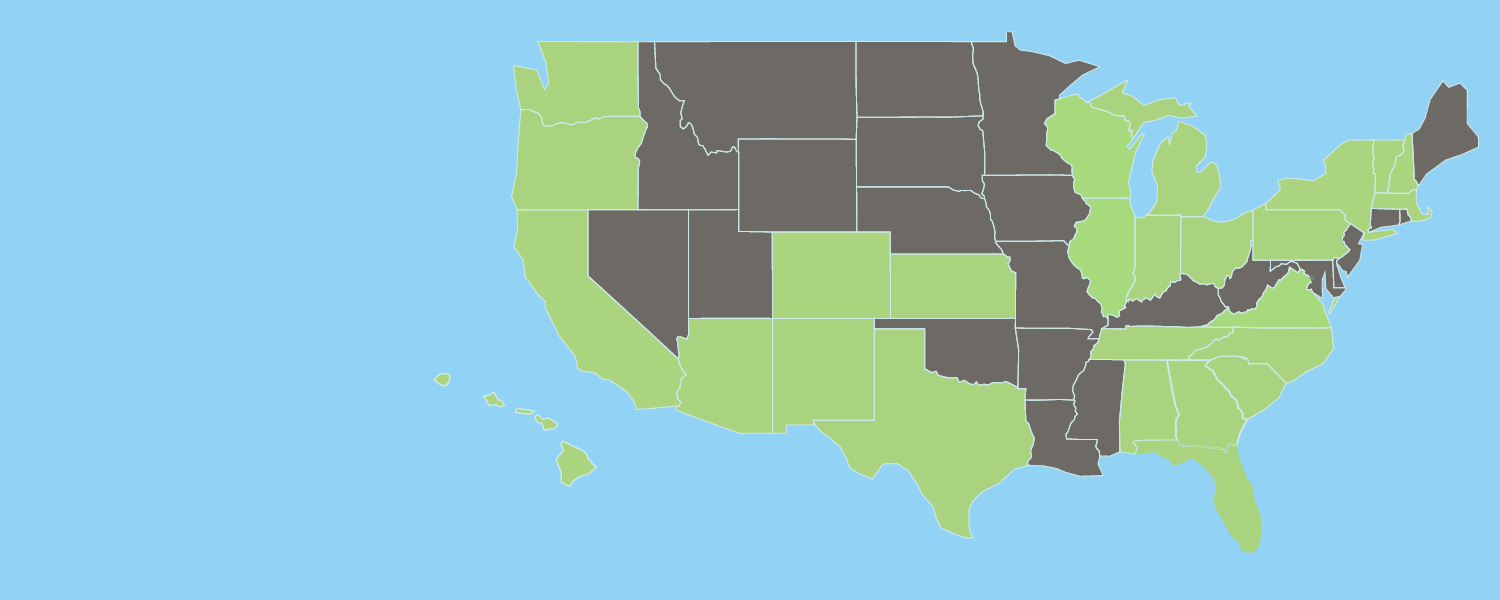

With a focus on innovation, world-class medicine, and unparalleled care, Ethos brings hope to pets and people during their times of greatest need. Find an Ethos hospital near you:

About UsFind an Ethos Veterinary Health Hospital near you! We’re a family of 145 world-class specialty and emergency hospitals in the US and Canada.

Our teams are dedicated to medical excellence, innovation, and providing exceptional, compassionate care to pets and people in their times of greatest need.

Ethos Veterinary Health is hiring across the country. We have openings for doctors, specialists, technicians, and administrative and support team members at all of our hospitals.

Consider a career with Ethos Veterinary Health - apply today!

Ethos Discovery is a 501(c)3 nonprofit organization devoted to delivering innovations that will improve the outcome for pets and humans afflicted with complex medical problems.

Ethos Discovery

Our Hospitals

Ethos Veterinary Health is a national network of veterinary hospitals providing unparalleled specialty and emergency care for pets.

Our HospitalsLatest News

National Veterinary Associates Appoints Medical Leadership for NVA General Practice and Ethos Veterinary Health Businesses

June 14, 2023Dr. Sandra Faeh to serve as Chief Veterinary Officer of NVA’s General Practice business; Dr. Stacy Burdick named Chief Medical Officer of Ethos Veterinary Health. Newly created senior leadership roles position NVA General Practice and Ethos Veterinary Health for the next chapter of industry leadership as distinct veterinary businesses.

Read ArticleJoin Our Email List

We're Hiring! View our list of open positions

Consider joining our team. Click the link to see a list of our open positions. We are always hiring veterinary technicians, administrative support staff, veterinarians and board certified specialists.

Apply Today!